Who we are

The Taxpayer Rights Advocate Office helps taxpayers who have been unsuccessful resolving their problems through Virginia Tax's regular processes. We aim to protect your rights and ensure your tax problems are handled promptly and fairly.

How we can help

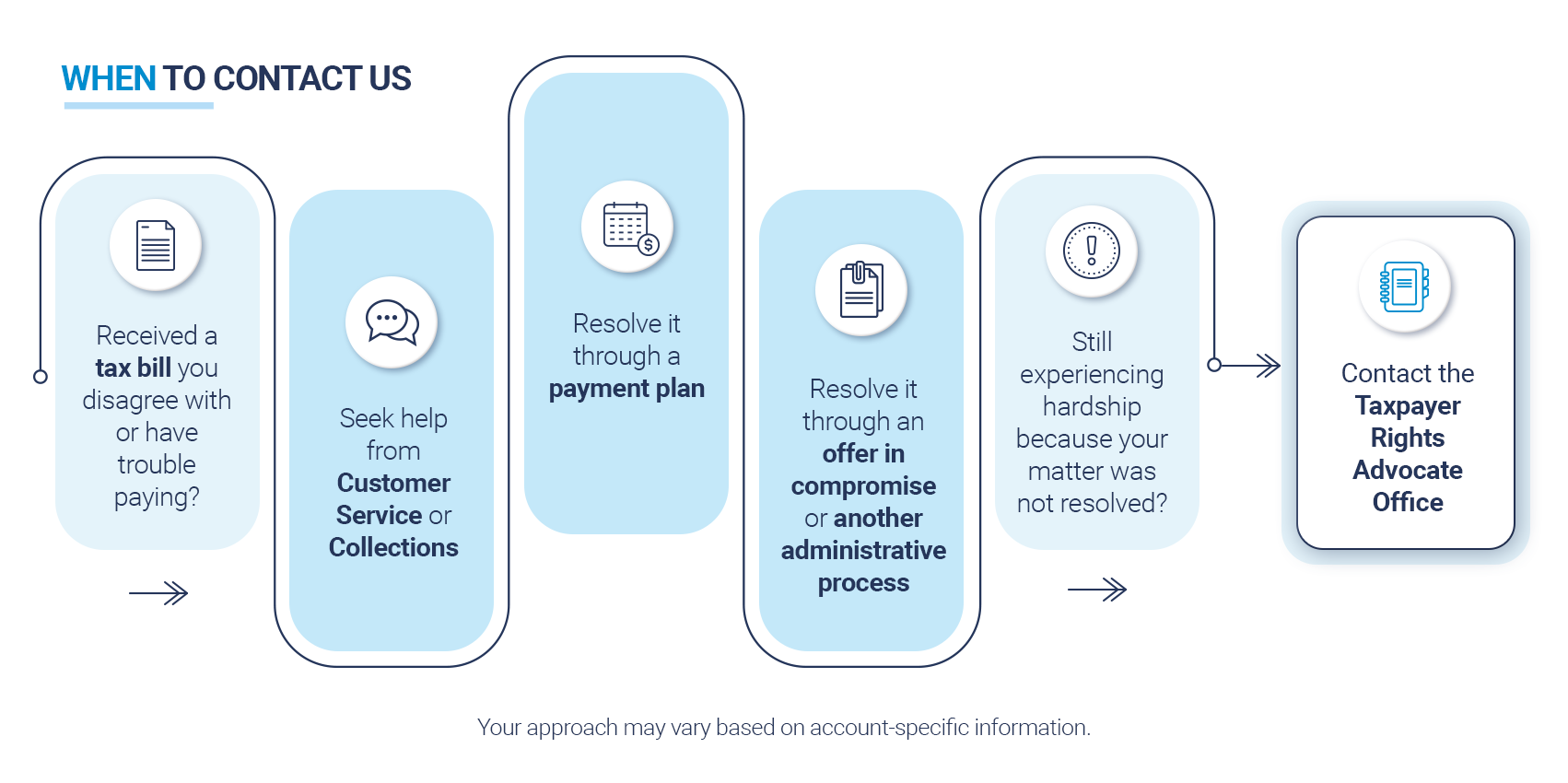

When to Contact the Taxpayer Rights Advocate Office

If you have followed Virginia Tax's regular processes to resolve your complaint or issue, but still need help, or have concerns that your rights as a taxpayer were not protected during a collections or audit process, please reach out to the Taxpayer Rights Advocate.

We will give priority in the following cases:

- You will suffer a significant hardship due to a tax determination, collection, or enforcement process.

- You will lose or be unable to maintain your house, purchase groceries, pay your utilities, or maintain your transportation to work.

- You will suffer adverse impacts such as significant loss of income, damage to your credit report, or damage that cannot be restored to its previous status.

- Virginia Tax was supposed to respond to you or resolve your request by a specific date, but you have not heard from them yet.

- A Virginia Tax system or procedure failed to operate as intended or could not resolve your problem or dispute.

How to contact us

Complete this form and email it to us at: TaxpayerAdvocate@tax.virginia.gov

You can also mail or fax it to us, but emailing is the fastest option.

Taxpayer Rights Advocate

Virginia Department of Taxation

PO Box 546

Richmond, Virginia 23218-0546

FAX: 804.774.3100

Taxpayer Rights Advocate Limitations

The Taxpayer Rights Advocate is unable to:

- Change the application of Virginia tax law for individual or business situations

- Interfere in an audit, handle a protest, waive taxes, penalties, or interest, or answer technical questions

- Act as a substitute in informal review or formal appeals procedures

- Reduce tax liability through an offer in compromise when taxes are legally due

- Grant or set payment plans

- Change time limits for filings, payments, or refunds

- Act as legal counsel

- Help you with your federal income tax, taxes you pay to other states, or Virginia localities

In many of these cases, you may be able to get help through regular Virginia Tax processes - some are outlined below.

Additional Virginia Tax Resources

- Virginia Taxpayer Bill of Rights

- Power of Attorney forms

- Audit Information

- Collections Information

- Voluntary Disclosure Program (for businesses only)

- Where's my refund? (for individual taxpayers only)

- Resources for Tax Professionals

- Customer Service Phone Numbers